Time Period For Revision Of Income Tax Return . there are time limits for lodging an amendment to a tax return. An online amendment takes about 20. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. The time limit starts from the day after the date on your notice of. individuals and sole traders have 2 years to lodge an amendment. You'll need to lodge an objection if you want to:. as per section 139(5) of the income tax act, the income tax return can be revised at any time 3 months before the end of the assessment year or before the completion of the assessment process whichever is earlier. individuals and sole traders generally have 2 years to submit an amendment to their tax return. you can submit an amendment to your income tax return using our online services.

from www.studocu.com

You'll need to lodge an objection if you want to:. you can submit an amendment to your income tax return using our online services. An online amendment takes about 20. individuals and sole traders generally have 2 years to submit an amendment to their tax return. as per section 139(5) of the income tax act, the income tax return can be revised at any time 3 months before the end of the assessment year or before the completion of the assessment process whichever is earlier. The time limit starts from the day after the date on your notice of. individuals and sole traders have 2 years to lodge an amendment. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. there are time limits for lodging an amendment to a tax return.

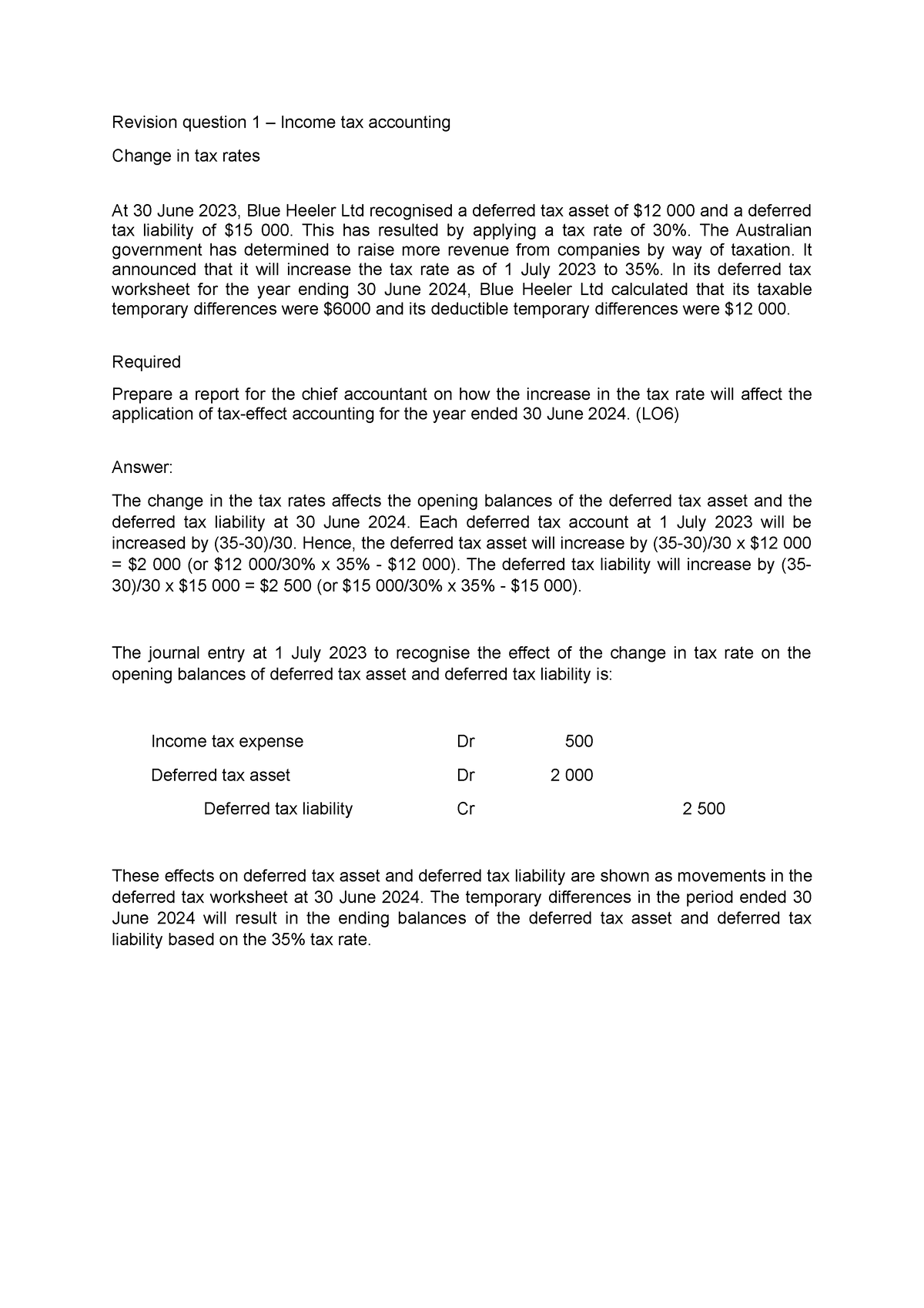

Revision questions and answers tax accounting Revision

Time Period For Revision Of Income Tax Return You'll need to lodge an objection if you want to:. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. An online amendment takes about 20. You'll need to lodge an objection if you want to:. individuals and sole traders generally have 2 years to submit an amendment to their tax return. as per section 139(5) of the income tax act, the income tax return can be revised at any time 3 months before the end of the assessment year or before the completion of the assessment process whichever is earlier. The time limit starts from the day after the date on your notice of. you can submit an amendment to your income tax return using our online services. individuals and sole traders have 2 years to lodge an amendment. there are time limits for lodging an amendment to a tax return.

From www.news18.com

Tax Return Filing Online Easy Steps To File ITR 1 Sahaj, Check Time Period For Revision Of Income Tax Return revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. as per section 139(5) of the income tax act, the income tax return can be revised at any time 3 months before the end of the assessment year or before the completion of the assessment. Time Period For Revision Of Income Tax Return.

From taxwalls.blogspot.com

Filing Of Quarterly Tax Return 2018 Tax Walls Time Period For Revision Of Income Tax Return revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. The time limit starts from the day after the date on your notice of. individuals and sole traders generally have 2 years to submit an amendment to their tax return. An online amendment takes about. Time Period For Revision Of Income Tax Return.

From www.alamy.com

Close up of UK tax return form with tax period for 2016 Stock Time Period For Revision Of Income Tax Return revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. individuals and sole traders generally have 2 years to submit an amendment to their tax return. You'll need to lodge an objection if you want to:. The time limit starts from the day after the. Time Period For Revision Of Income Tax Return.

From www.youtube.com

Comprehensive Revision of Tax in 10hrs CA Shrey Rathi Time Period For Revision Of Income Tax Return The time limit starts from the day after the date on your notice of. You'll need to lodge an objection if you want to:. you can submit an amendment to your income tax return using our online services. there are time limits for lodging an amendment to a tax return. revised return of income tax can be. Time Period For Revision Of Income Tax Return.

From www.financialexpress.com

Tax Return Revision Time Limit Can you revise ITR for AY 2022 Time Period For Revision Of Income Tax Return An online amendment takes about 20. you can submit an amendment to your income tax return using our online services. The time limit starts from the day after the date on your notice of. You'll need to lodge an objection if you want to:. revised return of income tax can be filed by an assessee any time before. Time Period For Revision Of Income Tax Return.

From www.taxmann.com

Rectification vs. Revision Proceedings under the Act with Time Period For Revision Of Income Tax Return as per section 139(5) of the income tax act, the income tax return can be revised at any time 3 months before the end of the assessment year or before the completion of the assessment process whichever is earlier. revised return of income tax can be filed by an assessee any time before the expiry of the relevant. Time Period For Revision Of Income Tax Return.

From www.caankur.com

Importance of Timely Tax Return Filing in India Time Period For Revision Of Income Tax Return You'll need to lodge an objection if you want to:. An online amendment takes about 20. there are time limits for lodging an amendment to a tax return. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. you can submit an amendment to. Time Period For Revision Of Income Tax Return.

From studylib.net

Revenue Law Tax simplified revision Time Period For Revision Of Income Tax Return you can submit an amendment to your income tax return using our online services. individuals and sole traders have 2 years to lodge an amendment. as per section 139(5) of the income tax act, the income tax return can be revised at any time 3 months before the end of the assessment year or before the completion. Time Period For Revision Of Income Tax Return.

From www.news18.com

9 Simple Steps To File Tax Return Time Period For Revision Of Income Tax Return You'll need to lodge an objection if you want to:. An online amendment takes about 20. individuals and sole traders generally have 2 years to submit an amendment to their tax return. you can submit an amendment to your income tax return using our online services. revised return of income tax can be filed by an assessee. Time Period For Revision Of Income Tax Return.

From www.youtube.com

Direct Tax Refund of Tax CS Executive Quick Revision Series All Time Period For Revision Of Income Tax Return The time limit starts from the day after the date on your notice of. individuals and sole traders have 2 years to lodge an amendment. An online amendment takes about 20. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. individuals and sole. Time Period For Revision Of Income Tax Return.

From www.taxscan.in

Acceptance of ITR without Adequate and Sufficient Enquiry by AO ITAT Time Period For Revision Of Income Tax Return You'll need to lodge an objection if you want to:. The time limit starts from the day after the date on your notice of. you can submit an amendment to your income tax return using our online services. there are time limits for lodging an amendment to a tax return. individuals and sole traders have 2 years. Time Period For Revision Of Income Tax Return.

From ifranchise.ph

What are the Taxes a Small Business Needs To Pay? Info Plus Forms And Time Period For Revision Of Income Tax Return revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. You'll need to lodge an objection if you want to:. you can submit an amendment to your income tax return using our online services. An online amendment takes about 20. The time limit starts from. Time Period For Revision Of Income Tax Return.

From www.youtube.com

10 Revision of tax Provident Fund and Numerical Of Salary Time Period For Revision Of Income Tax Return individuals and sole traders have 2 years to lodge an amendment. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. You'll need to lodge an objection if you want to:. you can submit an amendment to your income tax return using our online. Time Period For Revision Of Income Tax Return.

From www.scribd.com

RETURN OF Tax Refund Expense Time Period For Revision Of Income Tax Return You'll need to lodge an objection if you want to:. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. The time limit starts from the day after the date on your notice of. An online amendment takes about 20. you can submit an amendment. Time Period For Revision Of Income Tax Return.

From bemoneyaware.com

Filing Tax Returns after deadline Time Period For Revision Of Income Tax Return The time limit starts from the day after the date on your notice of. revised return of income tax can be filed by an assessee any time before the expiry of the relevant assessment year or before. there are time limits for lodging an amendment to a tax return. An online amendment takes about 20. individuals and. Time Period For Revision Of Income Tax Return.

From mpm.ph

Annual Tax Return Filing for Calendar Year 2022 Guidelines RMC Time Period For Revision Of Income Tax Return individuals and sole traders have 2 years to lodge an amendment. The time limit starts from the day after the date on your notice of. you can submit an amendment to your income tax return using our online services. there are time limits for lodging an amendment to a tax return. revised return of income tax. Time Period For Revision Of Income Tax Return.

From www.jagoinvestor.com

Check your tax refund status online & Learn how to use RTI Time Period For Revision Of Income Tax Return there are time limits for lodging an amendment to a tax return. The time limit starts from the day after the date on your notice of. You'll need to lodge an objection if you want to:. you can submit an amendment to your income tax return using our online services. An online amendment takes about 20. as. Time Period For Revision Of Income Tax Return.

From www.nytimes.com

How to Fill Out Your Tax Return Like a Pro The New York Times Time Period For Revision Of Income Tax Return The time limit starts from the day after the date on your notice of. individuals and sole traders have 2 years to lodge an amendment. individuals and sole traders generally have 2 years to submit an amendment to their tax return. there are time limits for lodging an amendment to a tax return. revised return of. Time Period For Revision Of Income Tax Return.